Online filing

Online filing is a four-stage process preceded by a Pre-validation Errors report.

Pre-Validation Errors Report

The Pre-Validation Errors Report will appear if you attempt online filing of a Return and computation which would fail HMRC validation in its current state. The report will identify the following issues and will direct you to the page of the software on which these should be corrected:

- Online filing credentials, including missing User ID, password of password confirmation

- Statutory details, such as Company Registration Number and Unique Tax Reference

- Return information details, such as the name and status of signatory

- Excessive Group relief surrender claims

- Total deductions and reliefs exceeding profits

You must correct all of the errors listed on the report before you can proceed to Online filing.

The Attachments page opens when you select Online filing.

Use the options to identify the submission type.

| Submit a new return | Identifies the submission as the original Company Tax Return CT600 for the selected period of account. |

| Submit an amended return | Advises HMRC that a Company Tax Return CT600 has already been submitted for this period and that this is an amendment to that return. |

| Do not submit a return for this period | Select this option if you are not submitting a Company Tax Return CT600 for the accounting period. This option is only needed in some circumstances, e.g. where the company is dormant for the accounting period and no notice to file a return (CT603) has been issued for that accounting period. |

iXBRL accounts

Use the options to provide information about the iXBRL accounts.

| Attached for the period to which the period relates | Identifies that attached accounts are for the same period as that covered by the Company Tax Return CT600. |

| Attached for a different period | Identifies that attached accounts are not for the same period as that covered by the Company Tax Return CT600. For example, where the accounts are for a period of more than 12 months. |

| Not attached because |

Choose if you are not attaching any accounts. In this case, use the drop-down box immediately below these options to select the reason for the non-attachment. Some of the choices in the drop-down require an explanation as to why you've not attached accounts, or why you've attached accounts for a different period etc. That explanation needs to be in the form of a PDF; it can be any document, spreadsheet etc. that you've saved as PDF. And that will be attached in the first following browse box. |

- If you've chosen an option in the drop-down box that requires an explanation, create your explanation file. This can be anything, such as a text document or a spreadsheet, but you must be able to save that file as PDF.

- In the first browse box, browse to and select your explanation file.

- In the second browse box, if applicable, browse to and select the set of accounts that you want to send.

Computations

If you have prepared an iXBRL tagged computation, tick Include iXBRL computation tagged on dd/mm/yyyy.

If you've tagged the computation, Include iXBRL computation tagged on <date> should automatically be ticked. If it's not, we recommend that you choose Tag Computation from Quick links and tag the computation before attempting to file online.

If you are not attaching a computation use the drop-down box to select the reason for the non-inclusion.

If an explanation is required it needs to be in the form of a PDF. Use the browse option to select the PDF.

Other attachments

- If you are adding other attachments to your submission, click Add, browse to locate the files and click Open.

- Click Next.

Note: Any other attachment must be a PDF, otherwise it will fail online filing validation.

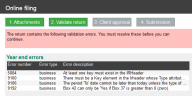

- The Validate return tab will either confirm that the Company Tax Return CT600 has passed HMRC online filing validation or will list the validation errors. The error descriptions will advise you of the cause of the error, and point you to the area of the file where you will need to amend your client's details. After correcting the these details, you will need to repeat the submission process.

- Click Next.

Tax pack

After validation, the file for submission to HMRC is compiled and the date and HMRC mark for this are displayed.

The HMRC (IR) mark is unique to this file. If data is subsequently amended, you will need to start the online submission process again to generate a new HMRC mark.

Client approval

Use Client approval to provide your client with the information they require to approve the Company Tax Return and computation.

Select any or all of the tick boxes to provide:

- Online filing declaration

- CT600 and supplementary pages

- Corporation tax computation

To complete this section you will need to enter the date the selected documents are sent to the client. The date entered in Sent to client for approval will automatically update Milestone & deadlines.

Click Next.

The Submission tab displays the details of the date the file was prepared and the IR mark, so you can verify that the file you submit is the correct file.

Enter the date on which the client approved the Return and computation at Client approval received. The date of approval in Milestones & deadlines will be automatically updated with the date entered here.

You can close this page and submit the file later or you can file immediately by clicking Submit.

You will receive a confirmation message that the submission has been made. For additional information about the submission and confirmation that it has been accepted by HMRC, go to Administration > Online filing history .

How do I get here?

Quick links > Online Filing